11+ Insurance Agency Agreement Templates in DOC | PDF

The insurance policy in insurance is an agreement between the insurer and the insured, known as the policy holder, that dictates the assertions that the insurer is legally obliged to pay. In return for an upfront payment, recognized as the premium, the insurer pledges to pay for losses incurred by dangers enclosed by the dialect of the policy.

Agreement Template Bundle

File Format

11+ Insurance Agency Agreement Templates in DOC | PDF

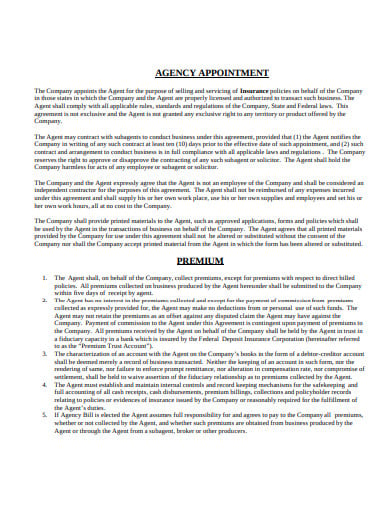

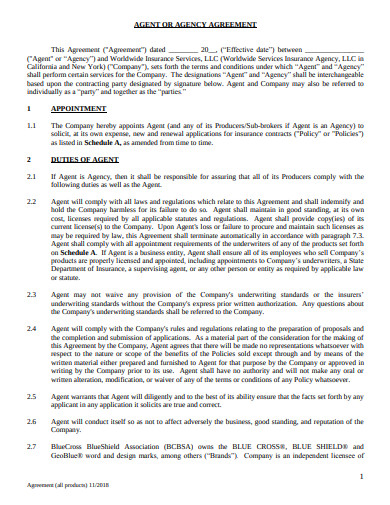

1. Insurance Agency Agreement Template

equinemortality.com

File Format

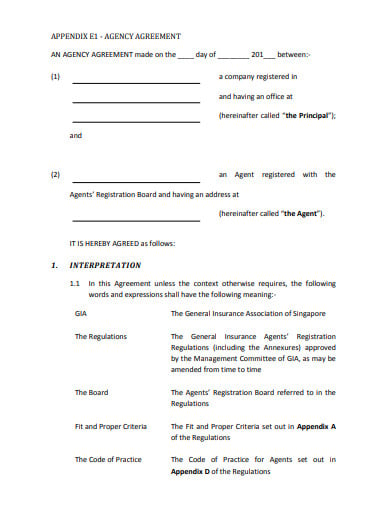

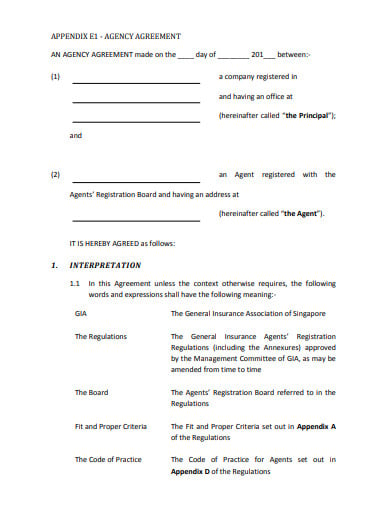

2. General Insurance Agency Agreement Template

gia.org.sg

File Format

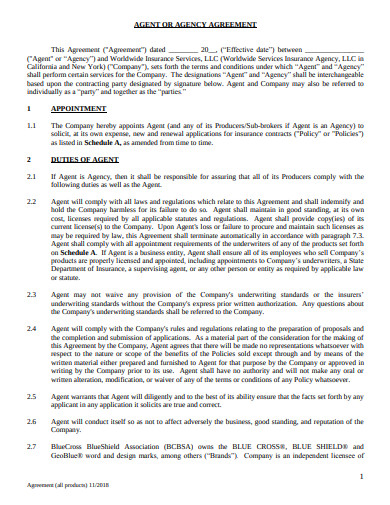

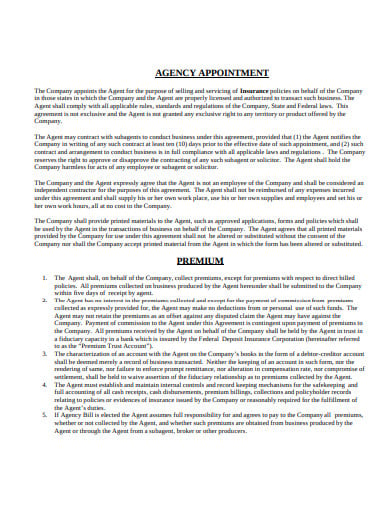

3. Company Insurance Agency Agreement Template

hthtravelinsurance.com

File Format

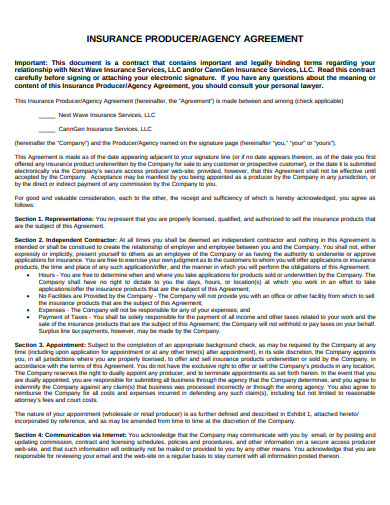

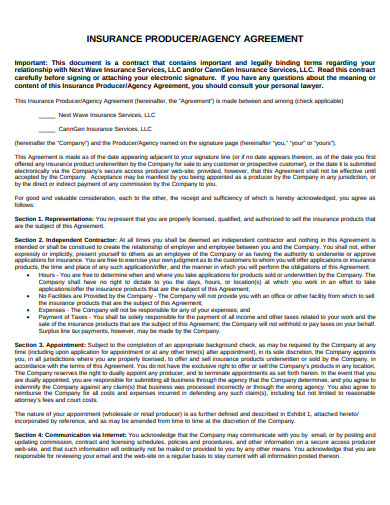

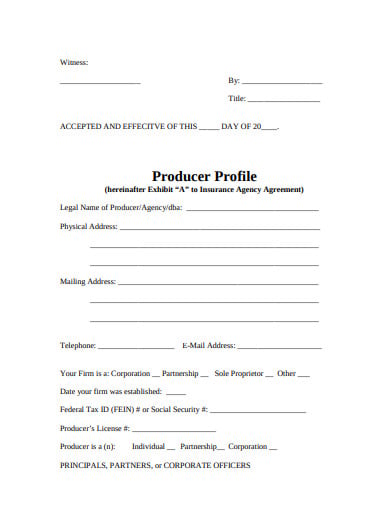

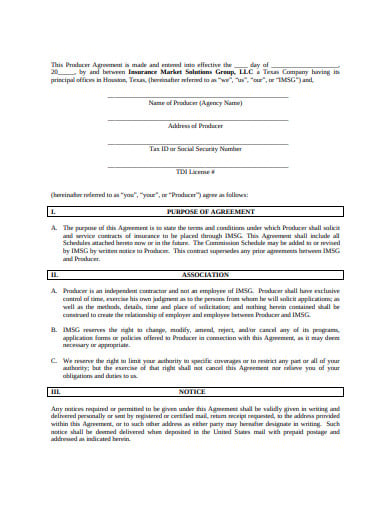

4. Insurance Producer Agency Agreement Template

nextwaveins.com

File Format

5. Insurance Services Agency Agreement Template

ira.go.ke

File Format

6. Sample Insurance Agency Agreement Template

ciusolutions.com

File Format

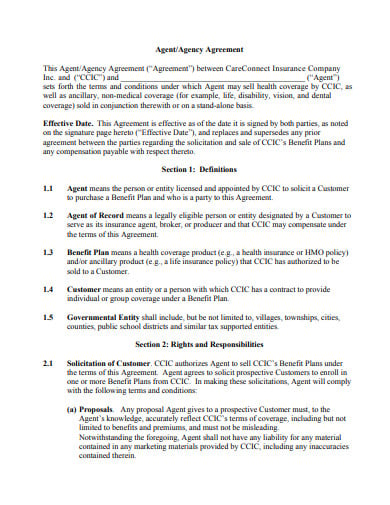

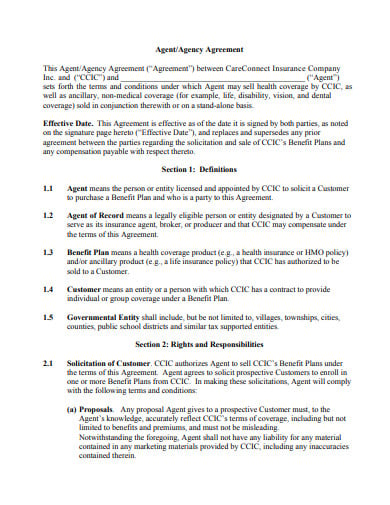

7. Insurance Company Agency Agreement Template

careconnect.com

File Format

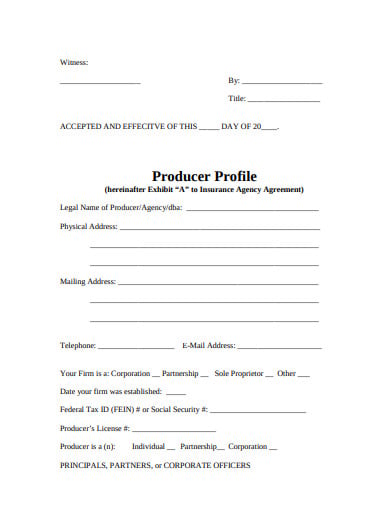

8. Insurance Agency Broker Agreement Template

patriotmanagers.com

File Format

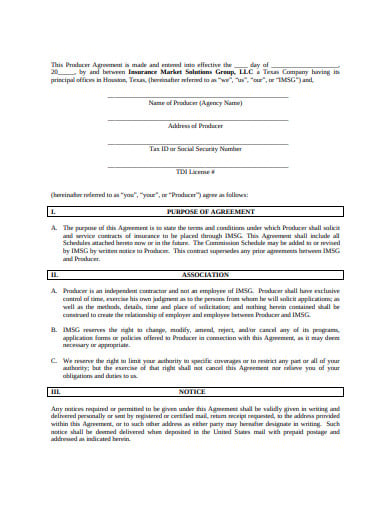

9. Insurance Sub-Producer Agency Agreement Template

imsgtx.com

File Format

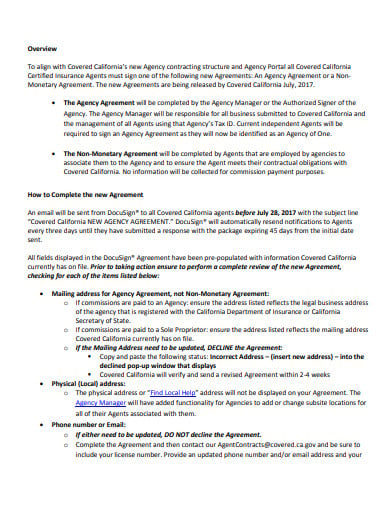

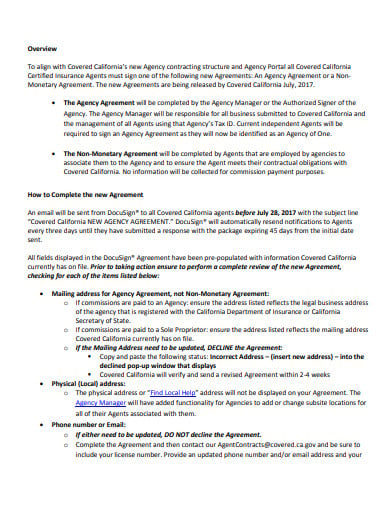

10. Agency Agreement Quick Guide for Certified Insurance Agents

hbex.ca.gov

File Format

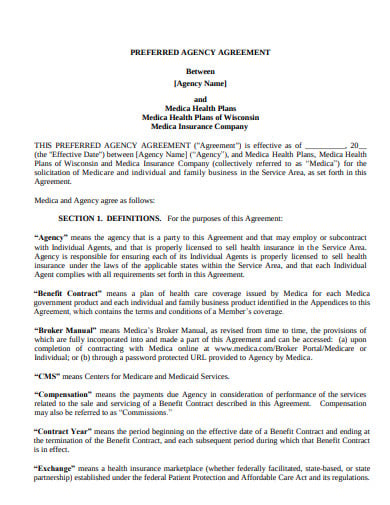

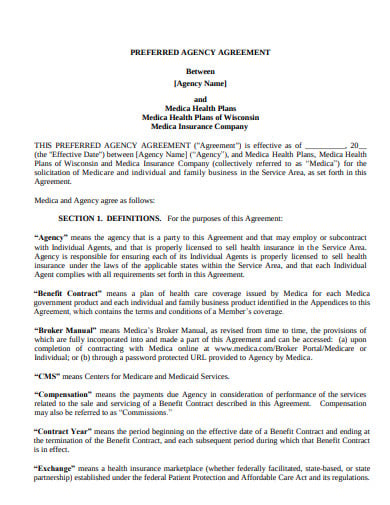

11. Preferred Insurance Agency Agreement Template

agentpipeline.com

File Format

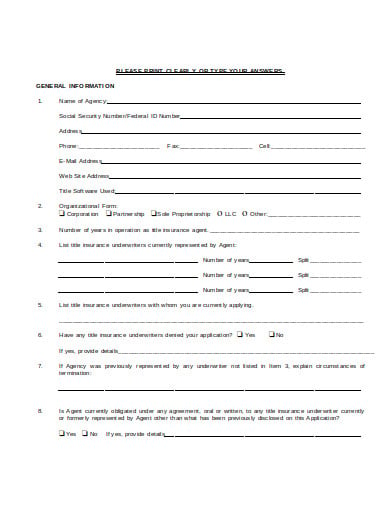

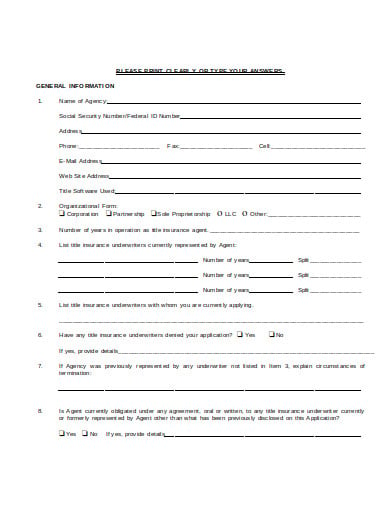

12. Insurance Agency Agreement in DOC

oldrepublictitle.com

File Format

General Features of an Insurance Contract

- Insurance policies are commonly regarded as adhesion contracts because the insurer drafts the agreement and the insured has little or no capacity to create substantial changes to it. This is taken to imply that if there is any ambiguity in any terms of the contract the insurer bears the burden. Insurance contracts are offered without a version of the agreement ever being seen by the policyholder.

- Insurance policies are impressionistic in that the sums the covered and the insurer brokers are different and rely on uncertain economic occurrences. Conversely, normal non-insurance contracts are commutative in that the quantities (or values) exchanged are typically meant to be approximately equal by the parties. This differentiation is especially relevant in the context of unusual items such as limited threat insurance which contains provisions for “commutation.”

- Insurance policies are coercive, implying that only the insurer makes contractual promises that are legally enforceable. The insured is not obliged to pay the premiums; however, if the insured has reimbursed the premiums and satisfied certain other basic provisions, the insurer is obliged to pay the benefits under the agreement.

- Insurance policies are governed by the concept of an utmost good conscience (uberrima fides), that requires both parties of the insurance contract to deal in good faith and, in particular, imparts to the insured an obligation to disclose all material facts relating to the risk to be covered. This is in contrast to the legal doctrine which covers most other types of contracts, caveat emptor (let the buyer be careful). In the U.S., the insured will sue an insurer for acting in bad faith.

Structure of an Insurance Contract

Historically, insurance policies have been written based on each type of risk (where risk was very narrowly defined), and a separate premium was calculated and charged for each sort of risk. The following points highlight the structure of an insurance contract:

Declarations

The section on agreements of an insurance policy defines the contracting parties and specifies that the relevant clauses form an insurance contract. It will typically assert the parties ‘ intentions regarding the subject matter of the insurance, the term of the policy, the dangers covered by the contract, the payment limits in the incident of an insured risk occurring, and the insured’s financial commitments.

Definitions

Most insurance policies include a specified section of terms that provides a common understanding of certain aspects or phrases used across the insurance policy. This segment may be very important if the agreement is to avoid ambiguities.

Terms of Insurance

- Named Perils Coverage: The mode of agreement accounts for the dangers specifically listed in the regulation. If the hazard is not listed, then it is not covered.

- All-Risk Coverage: This type of contract ensures all losses incurred by an individual or particular assets except those explicitly excluded losses. If the loss is not ruled out, it will be covered.

Exclusions

- Excluded Perils or Causes of Loss

- Excluded Losses

- Excluded property

Conditions

Circumstances are statutory clauses that require a specific fact or circumstance before obligations or duties arise under the contract. If contract conditions are not met, there is no obligation on the insurer to insure against the failure that is subject to the condition. That is, if an acceptable provision in the contract is not met, the insurer may deny a claim for damages. The insurer, for example, may file a claim and provide evidence of loss as a prerequisite for cover.

Endorsements

These are elements connected to the principal insurance contract used to change the policy’s tasks or responsibilities. Approval often places some condition on the insurer’s duty to compensate the insured or to cover a specific sort of loss. These may also change or remove express provisions in the heart of insurance policy. This is the main method used by underwriters to tailor a particular policy to suit a specific insured.

Policy Riders

Policy riders refer to changes to an existing policy. The rider consists of the revised terms and is part of the initial insurance contract. The insurer will use a rider whenever the liability conditions change under the regulation of an insured.